Financial wellness refers to our ability to have an understanding of and commitment to making healthy financial decisions concerning income, debt, and investments for both the short and long term.

Expenses vs. Income

Understanding your money and how you are using it starts by tracking and being aware of the money you have coming in and the money you are spending.

- Add up all the money you make each month. This is your monthly income.

- Add up all the money you spent this month. This is your monthly expense.

- If your expenses are equal to, or more than your monthly income, you’ll want to use a budget to ensure you are not spending beyond your means.

- If your expenses are less than your monthly income, a budget is still useful to help ensure you maintain good financial habits and can keep track of the amount of money you need for your expenses.

How to Budget

Budgeting is keeping track of your expenses and assigning each dollar to certain spending or saving categories.

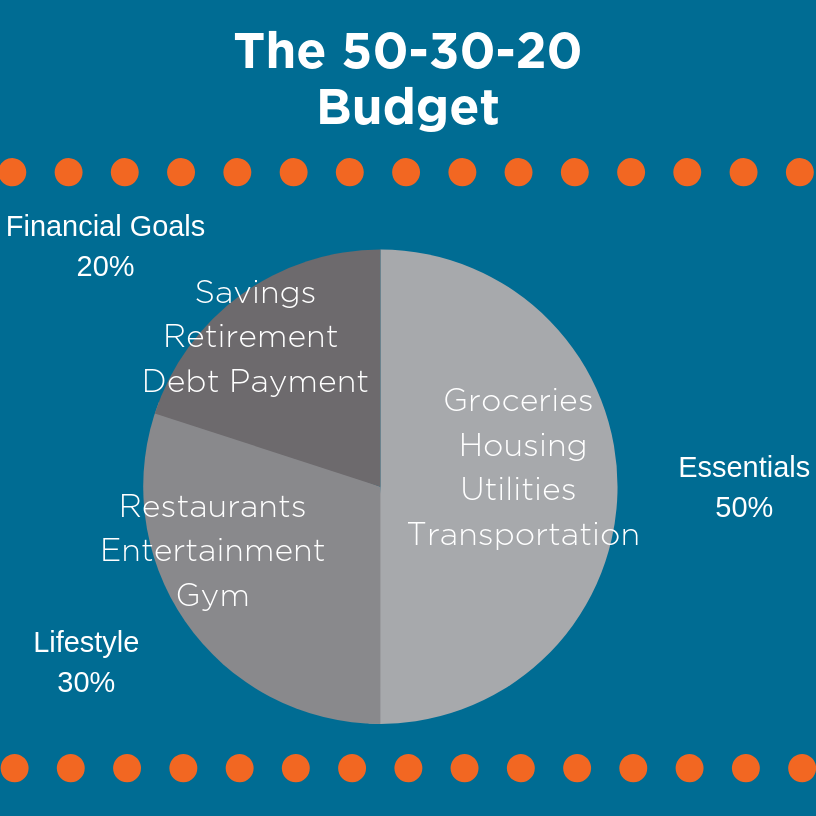

A good starting point is the 50/30/20 rule:

- 50% of your income towards necessities like housing and bills

- 30% of your income towards lifestyle like entertainment, dining out, and clothing

- 20% of your budget towards your financial goals like paying off debt or saving for retirement

There are a variety of different ways to create and keep track of a budget. These videos outline a few ways to help you get started. They are presented in order from the simplest approach to creating a budget, to one that is more in depth and detailed.

- Using a Spreadsheet to Make a Budget

- Budgeting Using the Every Dollar App

- Budgeting using Mint.com

Saving

Saving allows you to plan for future goals whether that’s moving to your dream city after you graduate, owning your car, or travelling. It also allows you to be prepared for emergency situations.

- Start by saving $1000 for an emergency fund. This will be used for unexpected expenses like car troubles, home repairs, or medical bills.

- Eventually, you will want to build your emergency fund to cover 3-6 months of living expenses. While in college this might not be necessary and paying down debt could be a better option. That said, you should always save at least a small amount even when prioritizing paying down debt.

- Saving has been shown to be more productive when you have a specific goal in mind, so dream big and start acting!

Managing Your Credit

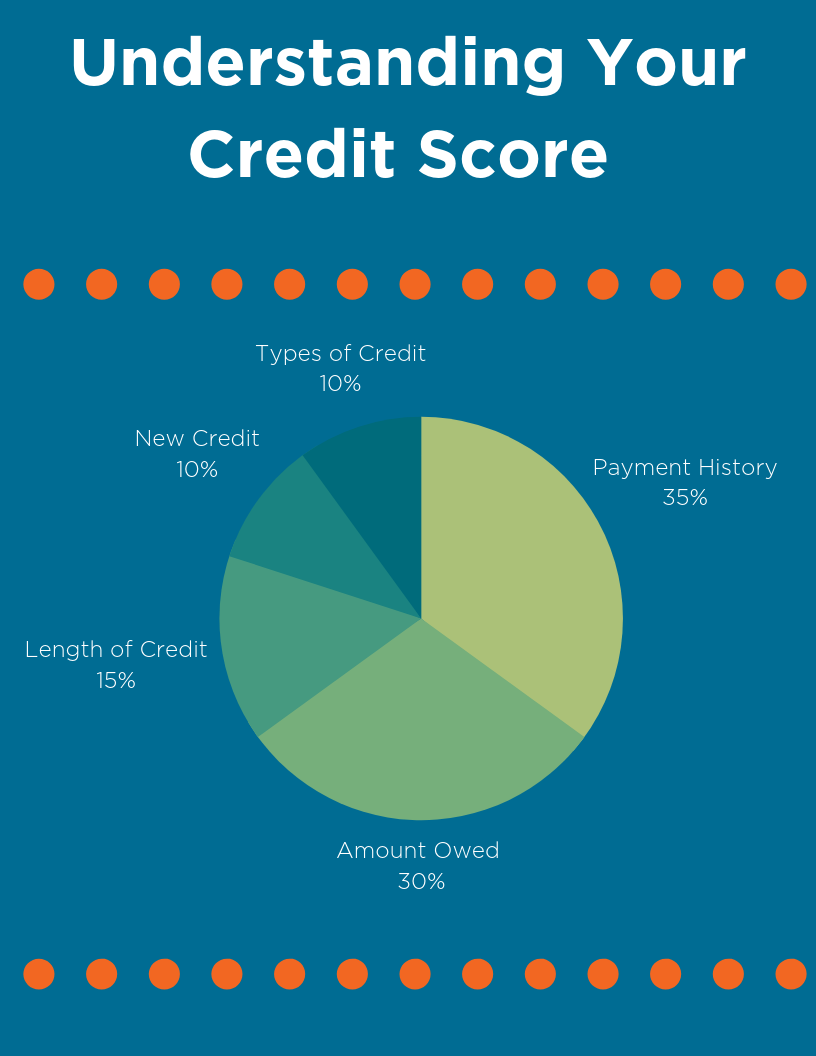

Credit is a snapshot of how well you can manage your money, especially money that you have borrowed. It can be used by employers, rental companies, car dealerships and more. Your credit score helps determine how much money a lender is willing to loan you.

Managing your credit involves multiple components: payment history, amount owed, length of credit history, new credit, and types of credit used.

To improve your credit score, start with small steps like:

- Making sure your credit report is accurate

- Paying down debt

- Paying bills on time

- Keeping a low balance on your credit card (less than 30% of your credit limit)

Getting a Free Credit Report

The law entitles you to one free copy of your credit report from each of the three nationwide credit report companies every twelve months. It is good to get into the habit of checking your credit report every year. This means you can check your account 3 times a year for free.

Checking your credit report is how you make sure your credit report is accurate. If you notice errors, contact the credit reporting company and provide the information to correct the error. Checking your credit report can also help you to protect yourself from identity theft.

Order your free credit report at: Annual Credit Report.com

Student Loans/Managing Debt

Tackling debt frees up your income. Instead of your money going towards debt repayment, it can go into a savings account, investment accounts, and towards the things that improve quality of life.

You may have debt from student loans (federal and/or private), credit cards, or auto loans. Whatever you may have borrowed money for, it is important to know what debt you do have. You can start by simply making a list and making note of what the debt is, the lender, current balance, interest rate, and minimum payment amount for each one.

There are two main approaches to paying down debt fast- the “Debt Snowball” method and the “Debt Avalanche” method.

Financial Wellness In and Out of the Classroom

- Invite a Financial expert for one-on-one appointments or speaking engagement

- Budgeting worksheets available for students

- Refer students to the on-campus food pantry, Big Orange Pantry, and Smokey’s Pantry

There are a number of resources that can help you get started on your financial journey, save money, and make a plan for your finances.

Campus Resources:

- Center for Financial Wellness

- One Stop

- Center for Career Development

- Smokey’s Closet and Other Closing Options

- Smokey’s Pantry

- Big Orange Pantry

- Free Store

- UT Financial Aid and Personal Cost Calculator

Off-campus Resources:

- Financial Aid Glossary for Key Terms

- Federal Student Aid

- Federal Student Aid – Loan Simulator

- Personal Finance Apps

- Mint

- Grad Sense

- Every Dollar: everydollar.com

- Qapital: qapital.com